sale of an asset for a net loss, write-down, write-off.Ĭredit vs.

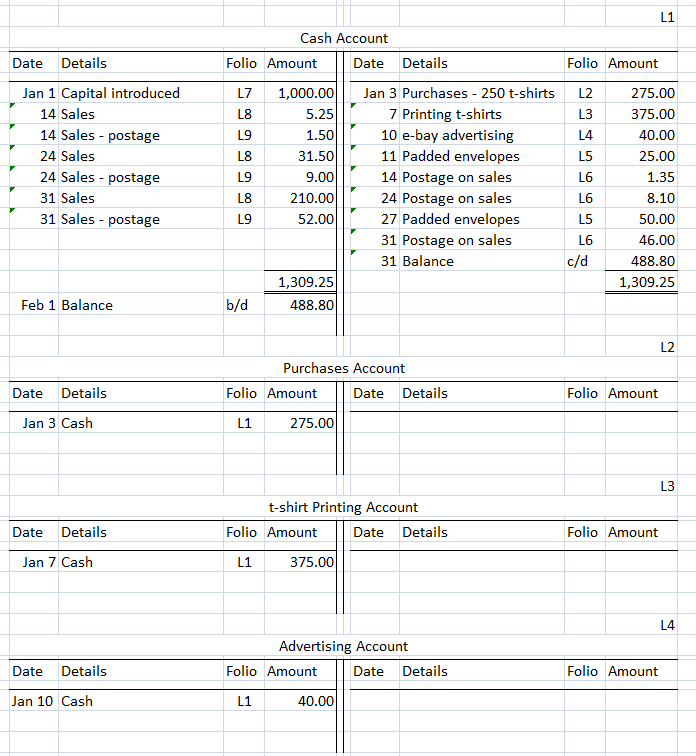

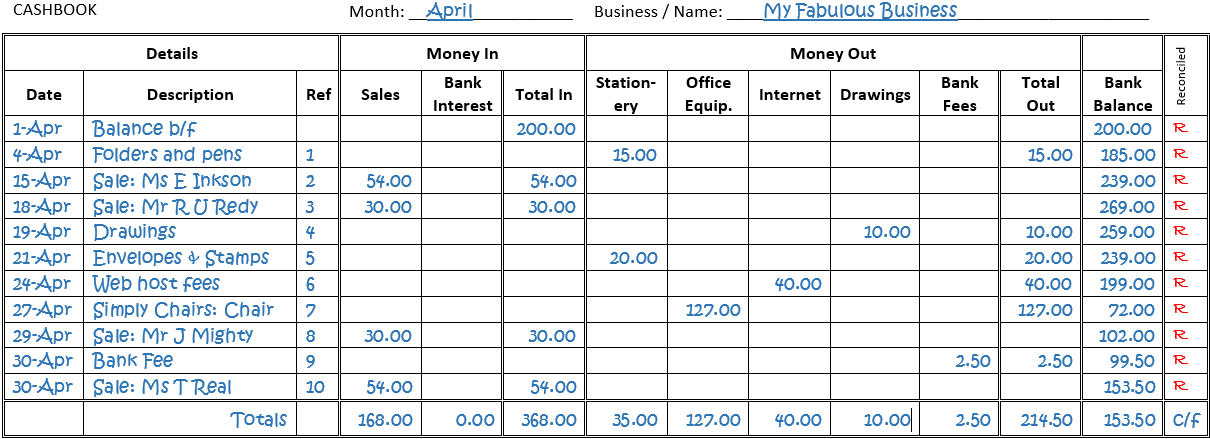

cash and cash equivalents, accounts receivables, inventory, property, plant and equipment (PP&E). Asset Account → The assets owned by a company, which either are items that either hold monetary value or represent future economic benefits, e.g.There are seven types of accounts in double entry accounting: Types of Accounts in a Double Entry Accounting On the general ledger, there must be an offsetting entry for the balance sheet equation (and thus, the accounting ledger) to remain in balance. The debit and credit treatment would be reversed for any liability and equity accounts. Credit to Asset → On the other hand, if the effect on the asset account’s balance is a reduction, the account would be credited, i.e.Debit to Asset → If the impact on an asset account’s balance is positive, you would debit the asset account, i.e.But if the company pays out cash (” outflow”), the cash account is credited. When determining the appropriate adjustment to cash, if a company receives cash (” inflow”), the cash account is debited. The debits and credits are tracked in a general ledger, otherwise referred to as the “T-account”, which reduces the chance of errors when tracking transactions.įormally, the summarized list of all ledger accounts belonging to a company is called the “chart of accounts”. Credit → Decreases Assets Accounts, Increases Liabilities and Shareholders’ Equity Accounts.Debit → Increases Assets Accounts, Decreases Liabilities and Shareholders’ Equity Accounts.

there must be an offsetting entry for all transactions to track the flow of money within a company.Ĭonceptually, a debit in one account offsets a credit in another, meaning that the sum of all debits is equal to the sum of all credits. Credit Accounting BasicsĮach transaction under double entry accounting results in a debit in one account and a corresponding credit in another, i.e. In short, a “debit” describes an entry on the left side of the accounting ledger, whereas a “credit” is an entry recorded on the right side of the ledger. Just like the accounting equation, the total debits and total credits must balance at all times under double-entry accounting, where each transaction should result in at least two account changes.Įach adjustment to an account is denoted as either a 1) debit or 2) credit. the company’s resources must have been funded somehow, with either liabilities or equity. The premise of the system is the accounting equation that states that a company’s assets must always be equal to the sum of its liabilities and equity, i.e. The double entry accounting system is a method for companies of all sizes to accurately record the impact of transactions and keep close track of the movement of cash. assets = liabilities + shareholders’ equity - to remain true.ĭouble Entry Bookkeeping System: Debit vs. Double Entry Bookkeeping is a standardized accounting system wherein each and every transaction results in adjustments to at least two offsetting accounts.Įach financial transaction must have an equal and opposing entry in order for the fundamental accounting equation - i.e.

0 kommentar(er)

0 kommentar(er)